In today’s economy, every dollar counts, and mastering the art of saving money has never been more important. The way we shop is deeply influenced by psychological triggers, and by understanding these subtle cues, you can significantly boost your savings. This comprehensive guide reveals 10 sneaky psychological tricks that can transform your spending habits, optimize your budgeting strategies, and help you achieve financial freedom. Backed by insights from consumer psychology and financial planning experts, these proven tips will empower you to make smarter decisions, avoid impulse purchases, and ultimately save money. Whether you’re searching for “money saving tips,” “budgeting hacks,” or “consumer behavior strategies,” read on to discover actionable advice that can revolutionize your wallet.

Enhance Your Spending Discipline: How High Heels Can Shift Your Shopping Mindset

Believe it or not, the simple act of dressing up can have a profound impact on your spending behavior. When you put on your high heels or any form of upscale attire before shopping, you subconsciously elevate your self-image. This heightened sense of confidence and sophistication often translates into more deliberate and mindful spending decisions.

Studies in consumer psychology suggest that when you dress in a more refined manner, you are more likely to perceive products as being of higher value—and conversely, you become more cautious about wasting money on low-quality or unnecessary items. This psychological trick leverages the power of appearance to help you maintain control over your budget. For more insights into how appearance influences spending habits, check out articles on Psychology Today.

Utilize New Currency to Enhance Spending Awareness and Control

Keeping new bills in your wallet can be an unexpectedly powerful money-saving tactic. Fresh, uncirculated currency tends to feel more valuable and carries a psychological weight that old, well-worn bills do not. This trick hinges on the novelty and perceived value of new money—each bill serves as a tangible reminder of your hard-earned cash.

When you handle new bills, you’re more likely to think twice before spending them impulsively. This strategy not only increases your spending awareness but also reinforces the idea that every dollar has a purpose. By being mindful of the condition of your money, you create a mental checkpoint that can help curb unnecessary expenditures. Learn more about the psychology of money and spending control from Investopedia.

Embrace Delayed Gratification: How Procrastination Can Boost Your Savings

In a world driven by instant gratification, the art of procrastination can actually be a secret weapon in saving money. By intentionally delaying a purchase, you allow the initial impulse to subside, giving you time to evaluate whether the item is truly necessary. This method, rooted in the psychology of delayed gratification, encourages you to weigh your options more carefully and avoid impulse buys.

When you procrastinate, you create a cooling-off period that can help differentiate between a fleeting desire and a well-considered need. This mental pause is key to making rational financial decisions and is supported by numerous studies in behavioral economics. For further reading on delayed gratification and its impact on financial planning, visit NerdWallet.

Keep Shopping Interactions Short: Minimizing Sales Pressure to Save Money

Retail environments are expertly designed to maximize sales, and prolonged interactions with sales staff can often lead to unnecessary spending. Sales personnel are trained to build rapport and guide you toward additional purchases by engaging you in long conversations. To maintain control over your spending, it’s wise to keep your interactions with sales staff as brief as possible.

By minimizing conversation time, you reduce the chances of being influenced by persuasive marketing tactics. This strategy not only helps you stick to your shopping list but also ensures that you remain focused on your budget. For more tips on how to navigate high-pressure sales environments, check out consumer advice on Forbes.

Practice Cash-Only Transactions: Leave Your Bank Card Behind for Better Budget Control

One of the most effective ways to curb overspending is to adopt a cash-only approach. Leaving your bank card at home forces you to rely on the physical money in your wallet, making you more conscious of every purchase. When you see your cash depleting, you’re less likely to indulge in impulse buys.

This technique is a cornerstone of many budgeting strategies because it transforms abstract numbers on a screen into tangible cash that you can physically count. Behavioral economics research consistently shows that people tend to spend less when using cash compared to plastic. Explore more about cash-only strategies and their benefits on Business Insider.

Opt for Guest Checkout: How Avoiding Loyalty Programs Can Prevent Overspending

While loyalty programs and personalized marketing may seem beneficial, they can also lead to overspending by tempting you with exclusive offers and targeted discounts. One clever trick to avoid this is to check out as a guest when shopping online. By doing so, you bypass the personalized promotions that might nudge you into spending more than you planned.

Guest checkout minimizes the data collected about your shopping habits, reducing the frequency of targeted ads and promotions in the future. This approach helps you maintain a more controlled and deliberate shopping experience. For additional strategies on avoiding overspending, visit NerdWallet.

Leverage Product Reviews: How Informed Decision-Making Can Save You Money

Before making a significant purchase, especially on expensive items, take the time to read product reviews. Customer feedback can be invaluable in determining whether a product offers true value or is simply a costly gimmick. By checking reviews, you empower yourself with the knowledge to make smarter purchasing decisions.

Trusted platforms like Consumer Reports and CNET provide detailed reviews and product comparisons that can help you avoid financial pitfalls. This approach not only saves you money but also prevents buyer’s remorse—a common consequence of impulsive spending. Incorporating reviews into your shopping process is a must for anyone serious about personal finance.

Stimulate Your Senses: The Mint Trick to Curb Impulse Spending

It might sound odd, but something as simple as sucking on a mint when entering a store can help reduce your urge to spend impulsively. The mint trick works by subtly shifting your sensory focus away from the enticing aromas of a retail environment. This small distraction can diminish cravings and lower the likelihood of making an unplanned purchase.

This technique is grounded in the concept of sensory substitution, where a minor sensory stimulus can alter your overall perception of the shopping environment. Research in consumer behavior supports the idea that minor sensory inputs, like the taste of a mint, can influence your buying decisions. For more on the science behind sensory triggers and spending, explore articles on Psychology Today.

Create Your Personal Soundtrack: How Custom Music Choices Enhance Your Budgeting Mindset

Music has a profound impact on our emotions and decision-making processes. By turning on your own music while shopping, you create a familiar and controlled auditory environment that can significantly reduce stress and distraction. Familiar tunes help you focus on your shopping list rather than getting lost in the store’s promotional atmosphere.

Customizing your shopping playlist with music that calms and centers you can improve your overall budgeting mindset. Studies have shown that music can influence consumer behavior by affecting mood and cognitive function. This low-cost tactic is an excellent way to maintain control over your spending. For further reading on music’s influence on behavior, visit Harvard Business Review.

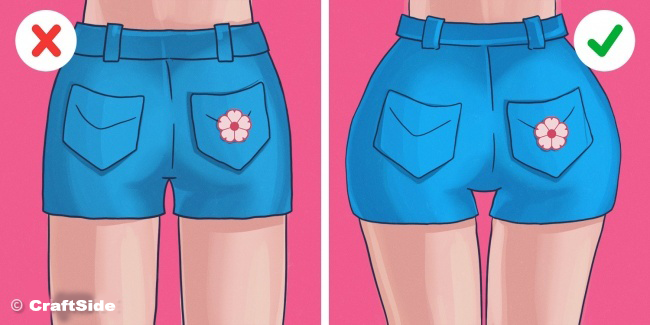

Limit Physical Interaction: How Minimal Product Contact Can Prevent Impulse Buys

One of the most subtle yet effective psychological tricks to save money is to avoid excessive physical interaction with products. The more you touch an item, the more emotionally attached you become to it, which can lead to an increased likelihood of purchasing it on impulse. By limiting your contact with products, you reduce the risk of developing an unnecessary emotional connection that drives unplanned spending.

This approach is based on the psychology of ownership, where even the simple act of handling an item can make it feel more valuable. By consciously restraining from touching too many products, you create a mental barrier that helps preserve your budget. For more insights into how physical interaction influences consumer behavior, check out research on Behavioral Economics.

Conclusion: Transform Your Spending Habits with These Sneaky Psychological Tricks

Implementing these 10 sneaky psychological tricks can be a game-changer in your quest for financial freedom. From dressing up to enhance your spending discipline to minimizing product interactions that trigger impulse buys, each tip leverages key principles of consumer psychology to help you save money more effectively.

By adopting strategies like cash-only transactions and guest checkout, you not only take control of your spending but also foster a mindset that prioritizes long-term financial health. These techniques, when combined with informed decision-making—such as reading product reviews and managing sensory inputs—create a robust framework for smart budgeting and money management.

Remember, the journey to financial wellness is built on small, consistent changes. As you integrate these tips into your daily life, you’ll begin to notice a significant reduction in unnecessary spending and a corresponding increase in your savings. Share these strategies with friends and family, and start your journey toward a more financially secure future today.

For further tips on personal finance and money-saving strategies, explore additional resources on Investopedia, Forbes, and NerdWallet. Embrace these psychological hacks and transform your shopping habits—because every dollar saved is a step closer to financial freedom.

Leave a Reply